ABOUT THE PROJECT

INGRESS: Gateway to financial inclusion

One billion individuals are currently excluded from the financial and banking services: refugees, populations of countries with developing economies and alike. They live mostly in Sub-Saharan Africa and Asia, but also in Europe because of ongoing refugee crisis which began in February 2022. INGRESS provides access to cryptographically secured credit history for microlending in crypto and fiat currencies. By providing these people access to digital credit from private lenders, INGRESS intends to build additional line of support apart from welfare, giving financially excluded people the opportunity to participate in the economies. Lenders, in their turn, get reliable reputation system and possibility to earn interest. The whole ecosystem gets more competition, and the credit becomes more affordable, thus fostering the economic growth.

INGRESS does this by combining into one system the technological components which emerged over the last years: Decentralized Identifiers, Verifiable Credentials, digital wallets, cryptocurrencies and distributed ledgers in general, cryptography, including homomorphic encryption, and private biometrics.

We specifically address trust and security issues of digital economy using combination of biometric identification with private keys. This enables individuals possessing the private keys of re-verifying the credentials they own in unfortunate case of private key loss or compromise. We pay a special attention to privacy and personal data protection, enabling the technical means of securing sensitive information such as biometric information and credit history to the extent at which it can’t be used by malicious agents even providing that they got access to some data with social engineering.

We develop the system using the components developed by ONTOCHAIN, W3C, crypto community and our own developments, specifically designed and implemented for this purpose.

.

Motivation for the project:

The proposed solution will reside on the pillars of ONTOCHAIN ecosystem building blocks to deliver a user-centric, secure, reliable, and accessible digital credit. This validates the platform ability to serve its users with value which is unseen in the traditional credit organizations and bureaus.

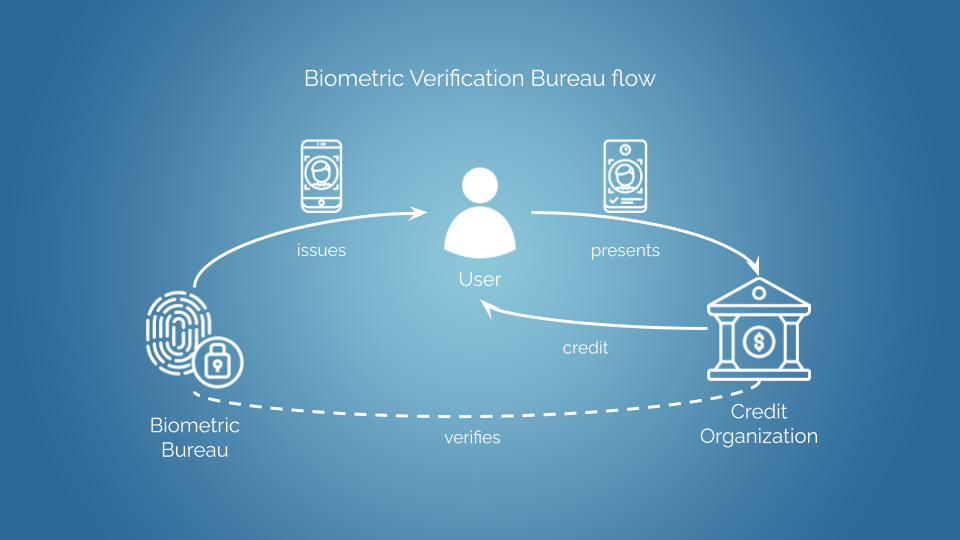

Generic use case description:

User gets digital wallet and confirms identity in a biometric bureau. Afterwards, they can verify identity within the credit organization and apply for credit. On approval, they start building a credit history and can gradually apply for more credit.

Essential functionalities:

Central part is a digital wallet, which is a place for storing the verifiable identity credentials. Biometric software for biometric user verification, and a mechanism for preventing the credit history from forging.

How these functionalities can be integrated within the software ecosystem:

The INGRESS digital wallet can be created through integration with Gimly wallet. The mechanism for preventing the credit history from forging can use blockchain timestamping as one of the protection layers

Gap being addressed:

INGRESS fills the gap between the end users with their needs and advanced technology, which does not have a particular use case despite advanced developments in decentralized systems, data protection and cyber security.

Expected benefits achieved with the novel technology building blocks:

Lenders enlarge the user base by providing services to unbanked people.

People get credit that will get cheaper due to the increased competition.

Fostering financial inclusion and digital economy, INGRESS helps to provide additional loan portfolio for the emerging economies and people in need.

Potential demonstration scenario:

The demo is planned in one of the European countries, with the Ukrainian refugees as a target group. INGRESS will provide these displaced people who might face financial struggles due to the forced displacement, cultural gap and possible absence of job, additional safety layer apart from welfare.

project outcomes

INGRESS is a microlending platform for unbanked people such as refugees and people from emerging economies. With biometrics, cryptographically verifiable credit histories and cryptocurrencies, we create a reliable mechanism for microlending.

Demo:

Repositories:

GitHub:

https://github.com/biometric-technologies/

https://github.com/ONTOCHAIN/INGRESS

Currently open to the ONTOCHAIN community only. Reach out if you need access.

TEstimonial

Over the past 10 months, the financial support and technological foundation provided by ONTOCHAIN have been integral to the progress and success of the INGRESS project. Their commitment to innovation and financial inclusivity has enabled the ONTOCHAIN team to turn their vision into reality. With the robust ONTOCHAIN platform, they have built a product designed to meet real-world challenges. We appreciate the opportunity to leverage their technology and financial backing, which were instrumental in driving our project forward. The journey with ONTOCHAIN is a testament to what can be achieved when innovation, technology, and vision align.

TEAM

CEO, Artem has worked with biometric technologies and consulted on the implementation of biometric systems for over 5 years.

CTO, Slava has been a developer for over 10 years and has a passion for working on impactful projects.

COO, Alex specialises in managing and delivering client focused projects. When not at Iriscan he runs one of the most successful Shopify development labs in Ukraine.

Communication and partnership strategy specialist with a focus on cyber, defence, and dual-use goods.

This project has received funding from the European Union’s Horizon 2020 research and innovation programme under grant agreement No 957338

This project has received funding from the European Union’s Horizon 2020 research and innovation programme under grant agreement No 957338